Eligibility for the State Pensioners’ Christmas Bonus (DWP)

Introduction:

The State Pensioners’ Christmas Bonus is a much-anticipated annual payment that adds a little festive cheer to the lives of pensioners in the UK. Introduced as a goodwill gesture, this payment, known as the state pensioners christmas bonus dwp is administered by the Department for Work and Pensions (DWP) to provide some financial relief during the holiday season. It is a tax-free bonus, designed to ensure pensioners feel supported and valued at a time when expenses typically increase.

Whether you’re receiving the State Pension or other qualifying benefits, the Christmas Bonus is a welcome boost. However, not everyone automatically qualifies, and understanding the eligibility requirements is crucial. In this guide, we’ll break down everything you need to know about the bonus, from its value to how you can ensure you don’t miss out.

Read Also: 1739 extra for universal credit payment: What to Know

What is the State Pensioners’ Christmas Bonus?

The State Pensioners’ Christmas Bonus is a one-off tax-free payment of £10, provided annually to eligible individuals during the festive season. Though the amount may seem modest, it symbolizes the government’s commitment to supporting pensioners and those on certain benefits.

Introduced in 1972, the bonus has remained a staple of holiday financial assistance for over five decades. While the sum hasn’t changed over the years, it remains an important token of appreciation for the elderly and vulnerable.

Key features include:

- Tax-free: The bonus does not affect your taxable income.

- Non-means-tested: You qualify based on receiving eligible benefits, not your income level.

- Automatic payment: Eligible individuals usually don’t need to apply.

Eligibility Criteria for the Christmas Bonus:

Understanding the eligibility requirements is essential to determine whether you qualify for this festive payment. Below, we’ll outline the main criteria.

Age Requirements:

To qualify for the Christmas Bonus, you generally need to be of pensionable age. As a rule of thumb:

- You must be receiving a State Pension or a qualifying benefit during the “qualifying week”, typically the first full week of December.

- Some younger individuals receiving specific disability-related benefits may also qualify.

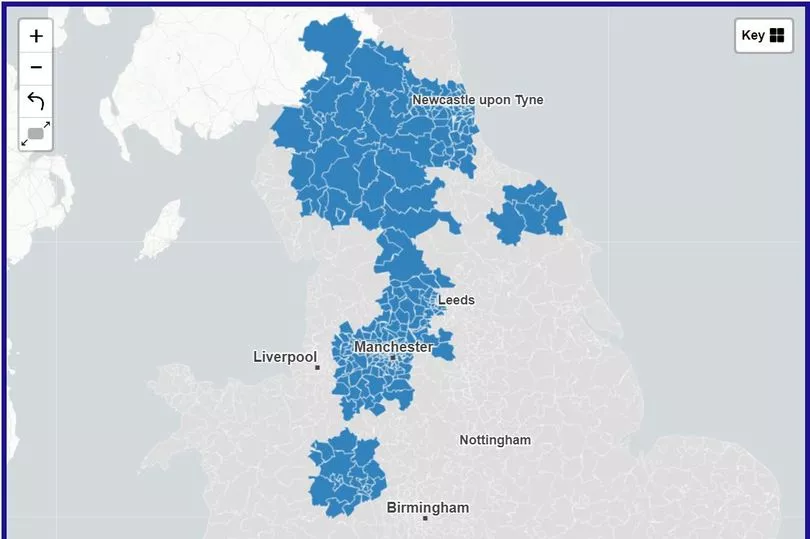

Residency Rules:

The bonus is primarily intended for pensioners living in the UK, but there are exceptions:

- UK residents: Most pensioners living in the UK qualify automatically if they meet other criteria.

- Overseas residents: Pensioners living in the European Economic Area (EEA) or Switzerland may still qualify. However, eligibility depends on continued receipt of qualifying benefits.

- Special circumstances: Some individuals with ties to the UK, such as Crown servants, may also receive the bonus abroad.

Benefits That Qualify:

Eligibility hinges on receiving at least one qualifying benefit during the qualifying week. These include:

- State Pension

- Disability Living Allowance (DLA)

- Personal Independence Payment (PIP)

- Attendance Allowance

- Incapacity Benefit

- Carer’s Allowance

- Severe Disablement Allowance

- War Widow’s Pension

Each benefit has unique criteria, and the DWP ensures individuals on these benefits are automatically assessed for the Christmas Bonus.

How to Claim the Christmas Bonus:

The process for receiving the Christmas Bonus is straightforward:

- Automatic payment: If you qualify, the £10 will be credited directly to your bank account. It usually appears alongside your regular benefit or pension payment.

- Delayed payment: If you don’t see the bonus by mid-December, contact the DWP to inquire about your case.

- Proactive checks: Ensure your personal information, such as bank details, is up-to-date with the DWP.

Exemptions and Disqualifications:

Not everyone is eligible for the Christmas Bonus. Common reasons for disqualification include:

- No receipt of a qualifying benefit during the qualifying week.

- Living in a country where the UK has no agreement for payment of the bonus.

- Being subject to certain sanctions on your benefits.

When is the Bonus Paid?

The Christmas Bonus is usually paid during the first two weeks of December. However, bank holidays or incorrect payment details can cause delays. If you haven’t received the payment by the third week of December, contact the DWP for assistance.

Read Also: 1739 extra for universal credit payment: What to Know

Conclusion:

The State Pensioners’ Christmas Bonus is a small but meaningful gesture that brightens the holidays for pensioners and benefit recipients. By meeting the eligibility criteria and ensuring your details are updated with the DWP (Department for Work and Pensions), you can enjoy this annual festive bonus without hassle. The state pensioners christmas bonus dwp initiative is a welcome reminder of the support provided to those who rely on these benefits during the festive season.

FAQs:

Is the Christmas Bonus taxable?

No, the bonus is entirely tax-free.

Can I receive the bonus alongside other benefits?

Yes, as long as you’re receiving one of the qualifying benefits.

What if I live abroad?

You may still qualify if you live in the EEA, Switzerland, or certain other countries with UK agreements.

How do I contact the DWP about the Christmas Bonus?

You can reach the DWP through their official helpline or your local Jobcentre Plus.

Is the bonus automatically renewed each year?

Yes, eligible individuals are assessed automatically during the qualifying week.