Table of Contents

ToggleTop Benefits of DWP Bank Accounts for Pensioners in the UK

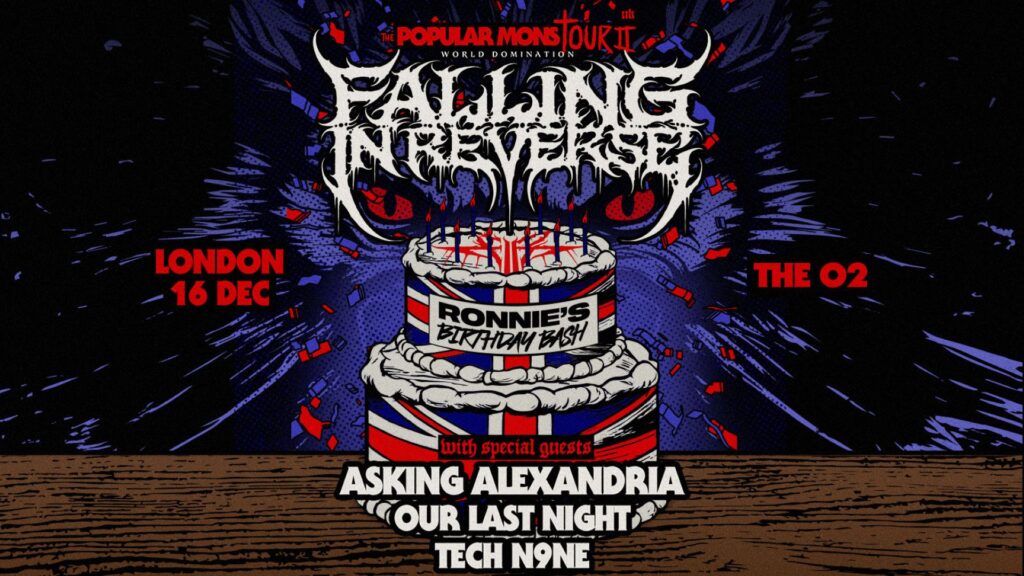

Image Credit: Daily Express

Introduction:

Managing finances in retirement can be challenging, but DWP (Department for Work and Pensions) bank accounts aim to make it easier for pensioners in the UK. These specialized accounts provide a secure, efficient way for pensioners to access their benefits and manage their money. Whether you’re new to the concept or considering switching from a traditional bank, understanding the advantages of these accounts can be a game-changer for your financial security.

Read Also: Eligibility for the State Pensioners’ Christmas Bonus dwp

What Are DWP Bank Accounts?

DWP bank accounts are specialized financial tools designed to simplify the management of pensions and benefits for UK residents. Offered by the Department for Work and Pensions, these accounts ensure seamless distribution of funds, particularly for those who might face challenges with traditional banking systems. The accounts cater specifically to pensioners, providing features that prioritize accessibility, security, and ease of use.

Unlike standard bank accounts, DWP accounts are tailored to help recipients manage government benefits effectively. They eliminate the need for intermediary bank processes, directly linking payments to the account holder for faster access.

Who Can Access a DWP Bank Account?

DWP bank accounts are primarily targeted at individuals who receive pensions or benefits from the UK government. Eligibility criteria include:

- UK residency.

- Receipt of pensions or other DWP-managed benefits.

- A need for a straightforward, no-frills banking option.

The application process is straightforward, often requiring basic identification and proof of benefit entitlement. Pensioners who meet these criteria can apply through the DWP website, over the phone, or at local support centers. For those unfamiliar with digital applications, dedicated assistance is available to guide them through the process.

Top Benefits of DWP Bank Accounts:

Seamless Pension Payments

One of the standout benefits of DWP bank accounts is the convenience of automatic pension payments. Once set up, pensioners no longer need to worry about missed or delayed deposits. The system ensures that payments arrive on time, providing a steady financial lifeline for retirees.

This automatic process also eliminates the hassle of manually cashing checks or visiting banks frequently, which can be especially beneficial for those with mobility issues or living in remote areas.

Enhanced Accessibility:

DWP bank accounts are designed with user-friendliness in mind, particularly for the elderly. Features include:

- Digital Banking Options: Easy-to-use online and mobile banking platforms that help users check balances, manage transactions, and monitor their accounts from the comfort of home.

- Support for Unbanked Individuals: For those without prior experience in banking, DWP accounts serve as an entry point, providing essential banking services without the complexities of traditional accounts.

These accessibility features empower pensioners to take control of their finances, regardless of their familiarity with technology or banking systems.

Fee-Free Banking:

For pensioners on fixed incomes, every penny counts. DWP accounts eliminate hidden fees, ensuring that basic banking services like deposits, withdrawals, and fund transfers come without extra costs.

This cost-effectiveness means pensioners can focus their resources on essentials like healthcare, groceries, and leisure without worrying about unnecessary banking charges.

Financial Inclusion for the Vulnerable:

DWP accounts play a pivotal role in bridging the financial gap for pensioners in underserved communities. Many elderly individuals, especially those in rural or economically disadvantaged areas, struggle to access traditional banking services. DWP accounts provide a solution by:

- Offering straightforward banking options.

- Partnering with community centers to assist with account setup and management.

Additionally, the accounts are designed to accommodate individuals with disabilities, ensuring inclusivity through accessible platforms and customer service.

Simplified Budgeting Tools:

Managing money during retirement can be tricky, but DWP accounts offer tools to make it easier. Account holders gain access to free budgeting resources, workshops, and financial advice. These resources are tailored to help pensioners:

- Plan their expenses effectively.

- Track spending habits.

- Save for unforeseen circumstances.

By empowering users with financial literacy, DWP accounts not only provide convenience but also foster independence.

Security and Trust:

Safe Transactions

Security is a top priority for pensioners, and DWP accounts are equipped with advanced safeguards to protect users from fraud. Measures include:

- Two-factor authentication for online access.

- Fraud monitoring systems that detect and block suspicious activities.

These features give pensioners peace of mind, knowing their hard-earned pensions are secure.

Transparent Policies

Transparency is at the core of DWP banking services. Account holders receive clear guidelines about deposits, withdrawals, and transfers, minimizing confusion. This straightforward approach helps pensioners understand their rights and avoid unexpected issues.

Read Also: pip assessments dwp changes: Comprehensive Guide to Updates and Impacts

Integration with Government Benefits:

Streamlined Access to Additional Benefits

DWP accounts are seamlessly integrated with other government benefit programs. Pensioners can receive payments for housing, disability, and care benefits directly into their accounts. This reduces paperwork and ensures faster access to funds.

For example, if a pensioner qualifies for winter fuel payments or disability allowances, these can be deposited alongside their pension without additional bureaucracy.

Faster Resolution of Issues

DWP account holders benefit from dedicated customer support tailored to address pension-related concerns. The department provides priority service for inquiries, ensuring that account holders receive prompt assistance in resolving problems.

Challenges Addressed by DWP Bank Accounts:

Reducing Financial Exclusion

One of the primary goals of DWP accounts is to combat financial exclusion. Many pensioners, especially those in low-income groups, lack access to banking services. These accounts offer an inclusive solution, ensuring that everyone, regardless of their financial background, can manage their money effectively.

Alleviating Stress During Retirement:

Financial stress can overshadow the joys of retirement. DWP accounts remove many of the common pain points associated with managing pensions, allowing retirees to focus on enjoying their golden years without unnecessary worries about their finances.

How to Apply for a DWP Bank Account:

Step-by-Step Application Guide

Applying for a DWP bank account is a straightforward process designed to accommodate pensioners, including those who may not be tech-savvy. Here’s how to get started:

-

Gather Necessary Documents

- Proof of identity (passport, driver’s license, or ID card).

- Proof of address (utility bill, council tax statement, or bank statement).

- Your National Insurance Number.

-

Contact the Department for Work and Pensions

- Reach out via the DWP website or helpline to initiate your application.

- If you prefer face-to-face assistance, local support centers can help.

-

Complete the Application

- Provide your personal details and required documentation.

- Verify your benefit entitlements to confirm eligibility.

-

Receive Confirmation

- Once approved, you will receive details of your account.

- Set up online access if desired, or request physical statements for offline management.

Common Mistakes to Avoid During Application:

To ensure a smooth application process, watch out for these common pitfalls:

- Submitting Incorrect Documents: Ensure all documents are up-to-date and match the information you provide.

- Missing Deadlines: If required, respond promptly to DWP’s requests for additional information.

- Skipping Instructions: Follow all steps carefully to avoid delays.

Frequently Asked Questions About DWP Bank Accounts:

What is the difference between a DWP account and a regular bank account?

DWP accounts are specifically designed for managing pensions and benefits, while traditional bank accounts are more general-purpose. DWP accounts have no hidden fees, are easier to set up for pensioners, and directly integrate with government benefit systems.

How secure is my pension with a DWP account?

DWP accounts employ robust security measures, including fraud detection systems, two-factor authentication, and regular monitoring to protect your funds from unauthorized access or fraud.

Can I switch from a traditional bank account to a DWP account?

Yes, pensioners can transition from a regular bank account to a DWP account. The process involves contacting the DWP, verifying eligibility, and completing a simple application.

Are there any drawbacks to using a DWP account?

DWP accounts are highly beneficial but may have limitations compared to traditional banks, such as fewer advanced banking features (e.g., loans or credit options). However, they are ideal for pensioners prioritizing simplicity and reliability.

How can I get more information on DWP services?

For detailed guidance, visit the official DWP website, call their helpline, or visit a local DWP office. They also offer printed materials and workshops for those seeking further assistance.

Read Also: dwp triggers cold weather payments for another 200000 people

Conclusion:

DWP bank accounts offer a wealth of benefits for pensioners in the UK, combining accessibility, security, and simplicity. From seamless pension payments to financial inclusion, these accounts ensure retirees can manage their money stress-free. The integration with government benefits and transparent policies make them an invaluable tool for financial stability during retirement.

For pensioners seeking a straightforward, cost-effective solution, DWP accounts are a clear choice. Take the first step today by exploring this option and securing a more comfortable financial future.

FAQs Section:

- Are DWP bank accounts suitable for all pensioners?

Yes, they are designed specifically for pensioners receiving government benefits and pensions, ensuring accessibility and convenience for all. - Can I access my DWP account online?

Absolutely. DWP accounts come with digital banking options, allowing users to check balances, transfer funds, and manage accounts online. - How do I resolve issues with my DWP account?

Contact DWP’s dedicated customer service team for prompt assistance. They handle account-specific problems and pension-related inquiries. - Are there any alternatives to DWP bank accounts?

Pensioners can use traditional banks, credit unions, or Post Office accounts, but these may lack the tailored features and benefits of DWP accounts. - Is there a minimum balance requirement for DWP accounts?

No, DWP accounts are designed to accommodate pensioners without imposing a minimum balance requirement.