Table of Contents

Togglewhat is the hmrc warning on savings accounts

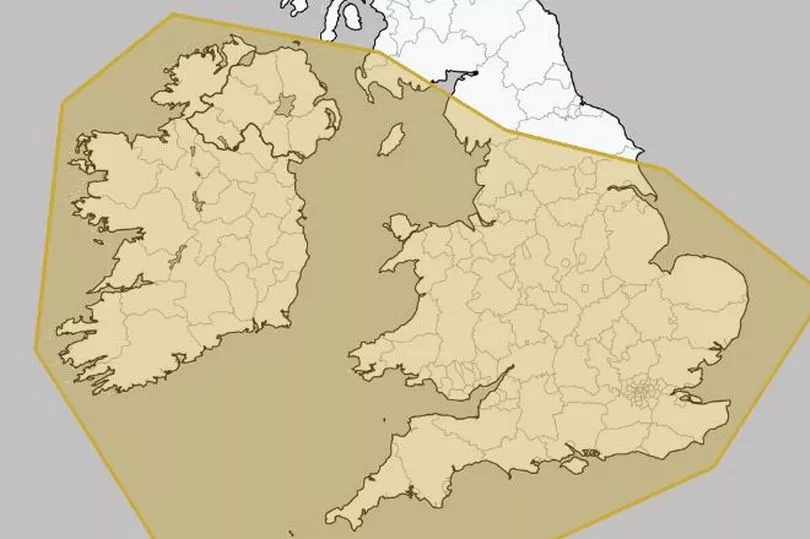

Image Credit: Birmingham Live

Understanding HMRC Warnings on Savings Accounts:

What Is HMRC?

Taxes are collected, tax laws are enforced, and compliance is ensured by Her Majesty’s Revenue and Customs (HMRC), the UK’s tax authority. Income tax, VAT, and savings account taxation are managed to fund public services and maintain economic balance. what is the hmrc warning on savings accounts

Savings Accounts and Taxation

Savings accounts are a common financial tool for individuals looking to grow their wealth. However, the interest earned on savings can be taxable, and HMRC keeps a close eye on these accounts to ensure all tax liabilities are correctly reported. For most taxpayers, this includes adhering to the Personal Savings Allowance (PSA), which exempts a certain amount of interest from tax each year. Any interest exceeding this threshold is taxable and must be declared.

Read Also: HMRC Savings Account Warning: Protect Yourself from Scammers

Why HMRC Issues Warnings on Savings Accounts:

Common Reasons for HMRC Warnings

HMRC warnings often arise due to discrepancies in the declaration of interest income. This can include failing to report interest that exceeds the PSA, or using savings accounts for tax evasion. With automated systems and increased transparency between banks and HMRC, undeclared interest is easier to detect than ever.

Taxable Income from Savings

Interest earned on regular savings accounts, fixed-term deposits, or even some offshore accounts may be subject to tax. Banks report interest earned by account holders directly to HMRC, so it’s crucial to ensure accurate reporting in your tax returns.

HMRC Warning on Savings Accounts: A Closer Look:

Increased Surveillance on Offshore Savings Accounts

The Crackdown on Hidden Savings

HMRC has intensified its focus on offshore savings accounts due to the global movement toward financial transparency. With international agreements such as the Common Reporting Standard (CRS), banks in participating countries are required to share financial information about account holders. This means that any savings or investments held overseas must be declared on your UK tax return. Failure to report these assets can result in significant penalties, even if the oversight was unintentional.

Transparency in International Savings

If you’ve been receiving warnings from HMRC about offshore accounts, it’s likely tied to undeclared income or discrepancies in your tax filings. HMRC encourages voluntary disclosure through its Worldwide Disclosure Facility (WDF), allowing taxpayers to rectify past omissions. Ignoring these warnings can lead to severe consequences, including investigations or prosecution.

Implications of Ignoring HMRC Warnings:

Financial Penalties for Non-Compliance

One of the immediate consequences of ignoring HMRC warnings is the imposition of financial penalties. These can range from fixed fines for late payments or inaccurate tax returns to higher penalties for deliberate attempts to evade tax. For example:

- Late Filing Penalty: An initial £100 fine if you miss the self-assessment deadline, with escalating fines for continued delays.

- Interest and Surcharges: Interest accrues on unpaid tax, increasing your liability.

In severe cases, HMRC may launch a criminal investigation, which could lead to prosecution.

Long-Term Impact on Credit and Finances

Non-compliance can affect more than just your current financial situation. HMRC warnings and subsequent penalties can damage your credit score, making it harder to secure loans, mortgages, or other financial products. Additionally, having a record of tax-related penalties may hinder your ability to access certain investment opportunities.

How to Stay Compliant with HMRC Rules:

Tracking Your Savings Interest

One of the simplest ways to stay on top of your tax obligations is by regularly reviewing the interest earned on your savings accounts. Many banks provide annual summaries of interest payments, which you can use to calculate your taxable income. Free tools and apps are also available to help track your earnings and ensure you’re staying within your Personal Savings Allowance (PSA).

Reporting Savings Interest Properly

For individuals whose interest income exceeds the PSA, reporting is essential. The process typically involves:

- Self-Assessment Tax Returns: If you’re self-employed or have significant savings income, you’ll need to file a self-assessment to declare your earnings.

- Consulting a Tax Professional: Tax rules can be complex, so seeking advice from an accountant or financial advisor can save you time and money.

Leveraging Tax-Free Savings Accounts

One of the best ways to minimize tax liability is by utilizing tax-free savings options, such as Individual Savings Accounts (ISAs). ISAs allow you to earn interest without paying tax, making them an excellent choice for those looking to maximize their savings.

Read Also: HMRC Savings Account Warning: Protect Yourself from Scammers

Conclusion:

HMRC warnings on savings accounts serve as a reminder of the importance of tax compliance. By staying informed about your obligations, keeping accurate records, and declaring all taxable income, you can avoid penalties and maintain financial peace of mind. Whether it’s through the use of ISAs or proper self-assessment filings, proactive steps can keep you on the right side of the law.

FAQs:

- What is the Personal Savings Allowance (PSA)?

The PSA is the amount of savings interest you can earn tax-free each year: £1,000 for basic-rate taxpayers and £500 for higher-rate taxpayers. Additional-rate taxpayers do not qualify. - How does HMRC track savings accounts?

Banks and financial institutions report interest payments directly to HMRC, ensuring transparency in taxable income from savings accounts. - Can I be fined for not declaring small amounts of savings interest?

Yes, even small amounts exceeding the PSA must be declared. Penalties can apply for undeclared income, regardless of the amount. - Are all types of savings accounts taxable?

Not all savings accounts are taxable. For example, interest earned in ISAs is tax-free, but regular accounts and fixed deposits are subject to tax if they exceed your PSA. - How can I find out if I need to pay tax on my savings?

Check your annual bank statements for interest earned and compare it to your PSA. If your total interest exceeds the allowance, you’ll need to report and pay tax on the excess.